Elite STR Fund:

Exclusive Short-Term Rental Investment Opportunity

Presented by The Syndication Doctor in Partnership with Wandery Capital

Invest in Luxury Short-Term Rentals

with Strong Cash Flow & High Upside

The Elite STR Fund offers accredited investors the opportunity to participate in a diversified portfolio of luxury short-term rental (STR) properties in high-demand destinations. Managed by Wandery Capital, this fund is structured to maximize both cash flow and long-term appreciation by acquiring, repositioning, and optimizing large, highly amenitized STR assets.

Investment Highlights

Projected 20%+ Net IRR

Targeting strong

risk-adjusted returns

Preferred Return: 11%

Cash flow distributions expected to begin 4th Quarter '24 or 1st Quarter '25

Investment Minimum: $50,000

Accessible entry for

accredited investors

Hold Period: 5-7 Years

Long-term growth with

strategic exit plans

High-Demand STR Assets

Large estate homes, boutique

hotels, and condo hotels

Tax-Advantaged Structure

Depreciation benefits

for investors

Why Invest in the Elite STR Fund?

Institutional-Grade Opportunity

in a Booming Sector

The short-term rental industry has grown beyond traditional hotels, driven by demand for private, experience-driven stays. With 12.7 million Airbnb units globally, STRs outnumber the top hotel chains combined.

Diverse Portfolio Across

Prime Markets

Investments span luxury estate homes, boutique hotels, and high-yield STR properties in Indio, Palm Springs, and Sedona, with plans to expand into additional high-demand markets.

Proven Strategy & Execution

Wandery Capital is already deploying Fund II capital, with $16M raised and invested into five properties, each undergoing strategic renovations to optimize cash flow

Attractive Exit Strategies

By building a high-performing STR portfolio, the fund aims to sell to institutional buyers seeking stable, cash-flowing assets at premium valuations.

Invest in Luxury Short-Term Rentals

with Strong Cash Flow & High Upside

Investor

Profit Split

72%

to investors

Target

Returns

20%+

Net IRR | 2.0x

Equity Multiple

Hold

Period

5-7

Years with flexibility

for optimal exit

Repositioning

Strategy

Luxury upgrades, enhanced guest experiences, direct booking platforms

Featured Properties

Lazy River Resort

Indio, CA (Operational)

6,047 SF

9 Bed, 9.5 Bath

1.5 Acres

12% Actual Cap Rate

Generating $1M+ in annual revenue

Luxury Amenities

Lazy River, Grotto and Islands, Pickleball, Mini-Golf, Bocce, Movie Theater

Wicket Lane

Indio, CA (Under Renovation)

6,047 SF

10 Bed, 9.5 Bath

1.2 Acres

12% Actual Cap Rate

Generating $1M+ in annual revenue

Luxury Amenities

Massive Water Slides, Beach Volleyball, Pickleball, mini-golf, Bocce, Movie Theater, Large Game Room

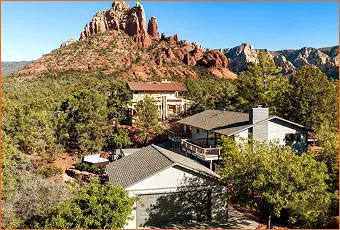

Sedona View

Sedona, AZ (Operational)

2,600 SF

4 Bed, 3 Bath

0.5 Acres

12% Actual Cap Rate

Generating $1M+ in annual revenue

Luxury Amenities

In ground Pool, Large Fire Pit, Spa, Large Game Room, Golf

Investor

Requirements

506(c) Offering

Open to accredited investors only

$50,000

Investment Minimum

Legal & Compliance

SEC-compliant private placement with full disclosures

This is not an offer to sell securities. Investments in private real estate funds involve risk, and past performance does not guarantee future results. Please review all legal documents and consult with your financial advisor before investing.